tax act online stimulus check

Resident alien in 2020 are not a dependent of another taxpayer for tax year 2020 and have a social security number valid for employment that is issued before the. Today my wife says we can still get the checks for our children if we fill out some stuff online.

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021

Offer Details Disclosures.

. Stimulus Check Information - CARES Act. Well I got this email today from TaxAct looks like well see our stimulus starting February. The One-Time Payment Of 1400 For Individuals And 2800 For Couples.

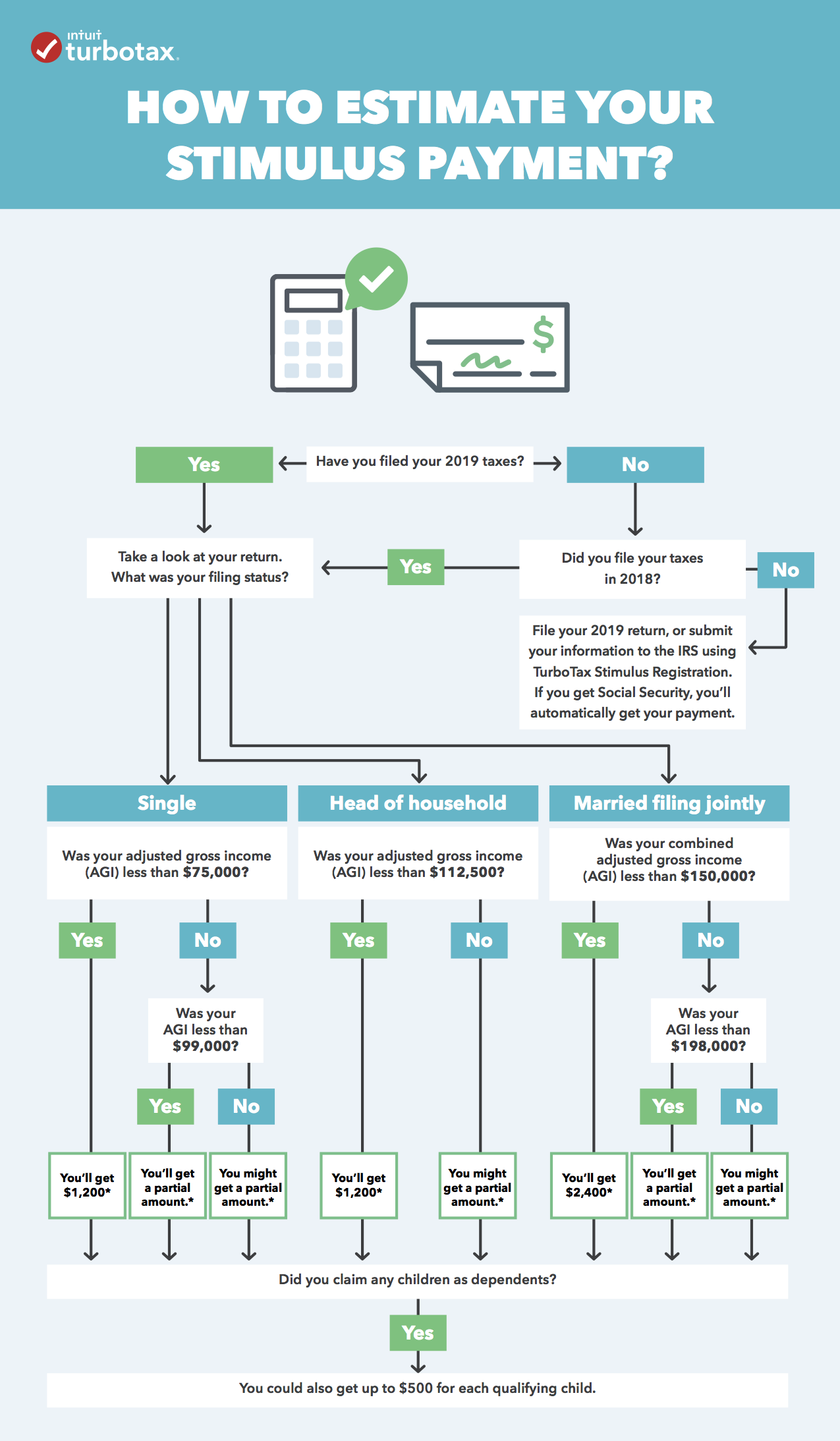

The package worth a sizeable 19trillion in relief which was passed in March is designed to give financial relief to those hardest hit by the economic impact of the coronavirus pandemic. How to get your stimulus check without filing taxes. The eligibility requirements for the second stimulus payment are the same as the first round of payments issued earlier in 2020.

Non taxpayers will need to visit the irs dedicated webpage for covid 19 stimulus checks click on the blue button that says non filers. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. A message from TaxAct President Curtis Campbell.

Click Add Bank Account. If a filer didnt get their stimulus money in 2021 TaxAct will ensure the stimulus money is added to the refund. In April my wife and I got our stimulus checks but not for our children.

Xpert Assist Premier 5495. The Treasury Department and the Internal Revenue Service today announced that distribution of Economic Impact Payments will. As part of the rescue plan payments worth up.

Check out our Form 1040 Recovery Rebate Credit FAQ page for instructions on how to report your stimulus payment using any TaxAct product. As a result to COVID-19 the Federal Government is taking action to ease the burden to taxpayers by passing the Coronavirus Aid Relief and Economic Security Act HR 748 also known as the CARES Act. If you didnt receive your first two stimulus payments issued in 2020 youll need to file a 2020 tax return which requires filing an Amended.

TaxAct provides tax preparation software online at four different price levels. First check if you received and saved Notice 1444 from the IRS. Up to 10 cash back Need to file your taxes or retrieve past tax returns.

If you need help finding the amounts you received there are a couple of options. I used Tax Act I like it a lot to be honest. The IRS will issue the stimulus payments through direct deposits and mailed checks.

The irs set the get my payment portal deadline for 13 may. Parents who welcomed a new baby in 2021 could be in line to get as much as 1400 in a stimulus payment Credit. Tax Act Users beware with regards to Stimulus checks.

Up to 10 cash back If filed after March 31 2022 you will be charged the then-current list price for TaxAct Xpert Assist federal and state tax filings and any other add-on services. The tool does not allow taxpayers to update their direct deposit info its only purpose is to show the status of stimulus payments. With the recent passing of the third stimulus payment youll be asked to enter both payments if received.

If your stimulus check was less than you deserved in 2021 youll need IRS. Enter bank name routing number account number and type of account click Continue. The Income Threshold Is 18000 For Married Couples And 80000 For Individual Filers.

Sign in to your TaxAct Account here. The third stimulus check is still going out having reached some 165 million Americans. A separate agreement is required for all Tax Audit Notice Services.

600 per child under the age of 17 Another COVID-19 relief bill with additional stimulus money is being discussed by Congress but has yet to be passed. Continue to check back here for the most up-to-date information. Xpert Assist Self Employed 7995.

This year I actually claimed my Mom she lives with me and we feed her. There Is Also A Child Tax Credit Of Up To. Latest on push for one group to get 4th stimulus check If youre getting ready to file your 2021 tax return click here for steps you can take to make filing easier.

Once you answer those questions the TaxAct product will let you know if you qualify for additional stimulus funds or if you received the correct amount. Youll Need This IRS Notice to Get More Money. It will show you both how and when you will receive your stimulus payment.

When filing with TaxAct you will be asked to enter the amount of your stimulus payment. Your stimulus check might be delayed if you filed your taxes with an online tax preparer. Free 0 Deluxe 45 Premier 70 and Self Employed.

Your stimulus payment will be direct deposited into your verified bank account. Be sure to check your stimulus check status or call the IRS stimulus check phone number with questions regarding your payment. The Internal Revenue Service IRS Will Allow Qualified Americans To Check The Status Of Their Third Economic Impact Payment Stimulus Payments.

Enter and verify bank account information complete all steps. The IRS stated customers should begin to see payments starting Feb. Xpert Assist Free 6495.

Read on for everything there is to know about the possibility of another round of payments. We are deeply disappointed that the IRS did not agree to the solutions we offered that would have likely delivered these funds as early as next week. According to the IRS a taxpayer is eligible if you were a US.

Stimulus payments may be delayed for as many as 14 million customers the IRS and major tax prep software. Xpert Assist Deluxe 4995. 600 stimulus checks with 600 for each eligible dependent were sent out as a part of the Coronavirus.

This credit only applies to the third stimulus payment which was issued in 2021. You can check the status of your payment with the IRS Get My Payment tool. Currently the second stimulus payout is as follows for those eligible.

Click Review bank account information. Can The Irs Take My.

Stimulus Check Update Here S What To Know If You Re Claiming A Stimulus Check On Your Taxes

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Stimulus Check Update The 2021 Deadline To Get Your Plus Up Payments Is Quickly Approaching Pennlive Com

Still No Third Stimulus Check Track Your Money Now With This Online Tool Tax Refund Income Tax Return Filing Taxes

Fourth Stimulus Check News Summary Sunday 6 June 2021 As Com

Stimulus Payments Have Been Sent I R S Says The New York Times

Stimulus Registration Economic Impact Payments Taxact

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Second Coronavirus Relief Package What Does It Mean For You And A Second Stimulus Check The Turbotax Blog

Where To Add Your Stimulus Money On Your Tax Return Taxact

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How To Claim A Missing Stimulus Check

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

Stimulus Check Face Mask In 2022 Internal Revenue Service Irs Prepaid Debit Cards

Stimulus Checks Tax Returns 2021